The Indian startup ecosystem hit a sobering reality check in Q3 2025. Funding numbers nosedived 38% YoY to $2.1 Bn as just 1 mega deal materialised and geopolitical tensions played the spoilsport. So, what dampened Q3 startup funding numbers?

A Cocktail Of Aberrations: Largely to blame for the subdued numbers was the escalating US-India trade uncertainties and cautious market sentiment. The near disappearance of mega deals (just one compared to 10 in Q3 2024) and increasingly cautious investors, preferring growth-oriented bets, also contributed to the decline.

Quarterly funding at a glance:

- Funding: Declined 38% from $3.4 Bn in Q3 2024

- Deal Count: Dipped 8.4% to 240

- Late Stage Funding: Tanked 54% to nearly $1 Bn

- Growth Stage Funding: $751 Mn, down 16% YoY

- Seed Stage Funding: A dip of 6% YoY to $200 Mn

- Unicorns: Zero compared to three in Q3 2024

- M&A Activity: 13 deals, down 28% YoY

Where Is The Capital Still Flowing? At the sectoral level, ecommerce emerged as the unlikely leader, raising $356 Mn across 56 deals, outpacing historically dominant sectors such as fintech and SaaS. AI and deeptech, too, took the spotlight as they grabbed big deals, signalling VC preference for innovation and resilience over high-burn growth.

What’s In Store For Q4? Looking ahead, investors remain cautiously optimistic, citing factors such as evolving economic conditions and uncertain US-India trade relations. According to Inc42’s survey, investors are displaying clear caution in late stage rounds but remain bullish on early stage, AI-driven investments.

What else? Read key insights from Inc42’s quarterly funding report here…

From The Editor’s DeskCan Arattai Last Beyond The Hype: Zoho’s messaging platform is riding the latest wave of digital “swadeshi” sentiment, clocking 3.5 Lakh downloads in just three days. Is this another run-of-the-mill WhatsApp-challenger, or something groundbreaking?

Capillary’s IPO Get SEBI Nod: The SaaS major has received the market regulator’s nod to float its IPO. Its public issue will comprise a fresh issue of shares worth INR 430 Cr and an OFS component of 18.3 Mn equity shares.

boAt Gets A New CEO: Ahead of its IPO, the consumer electronics startup has elevated its COO Gaurav Nayyar to the position of chief executive. Outgoing CEO Sameer Mehta will move to the role of executive director. Nayyar is boAt’s third CEO in the last three years.

Cleartrip’s FY25 Show: The Flipkart-owned online travel aggregator trimmed its net loss by 20% to INR 651.1 Cr in FY25 from INR 810.3 Cr in the previous fiscal year. Operating revenue grew 70% YoY to INR 169.2 Cr in FY25.

E2W Registrations Take A Hit: Total electric two-wheeler registrations declined 8.3% to 96,205 units in September from 1.04 Lakh in August. Ather surpassed Ola Electric to grab the third spot while Bajaj Auto regained the second place on the sales chart during the month.

Aequs Files Updated DRHP: The contract manufacturing startup has filed its updated draft papers with SEBI to raise INR 720 Cr via fresh issue and an OFS of 3.2 Cr shares. Aequs’ net loss zoomed 7X YoY to INR 102.5 Cr in FY25 while revenue declined 4% YoY to INR 924.6 Cr.

Anthropic’s India Plan: The AI major plans to hire a country lead for India as part of its global expansion strategy. Notably, OpenAI is also planning to open its office in Delhi. Last month, the Sam Altman-led company appointed India lead for its education vertical.

Ironclad’s ESOP-Focussed Fund: The investment firm has launched an INR 200 fund to buy vested ESOPs from startup employees. It plans to execute 30-40 secondary transactions in the range of INR 1-4 Cr in startups across segments like fintech, consumer, SaaS and AI.

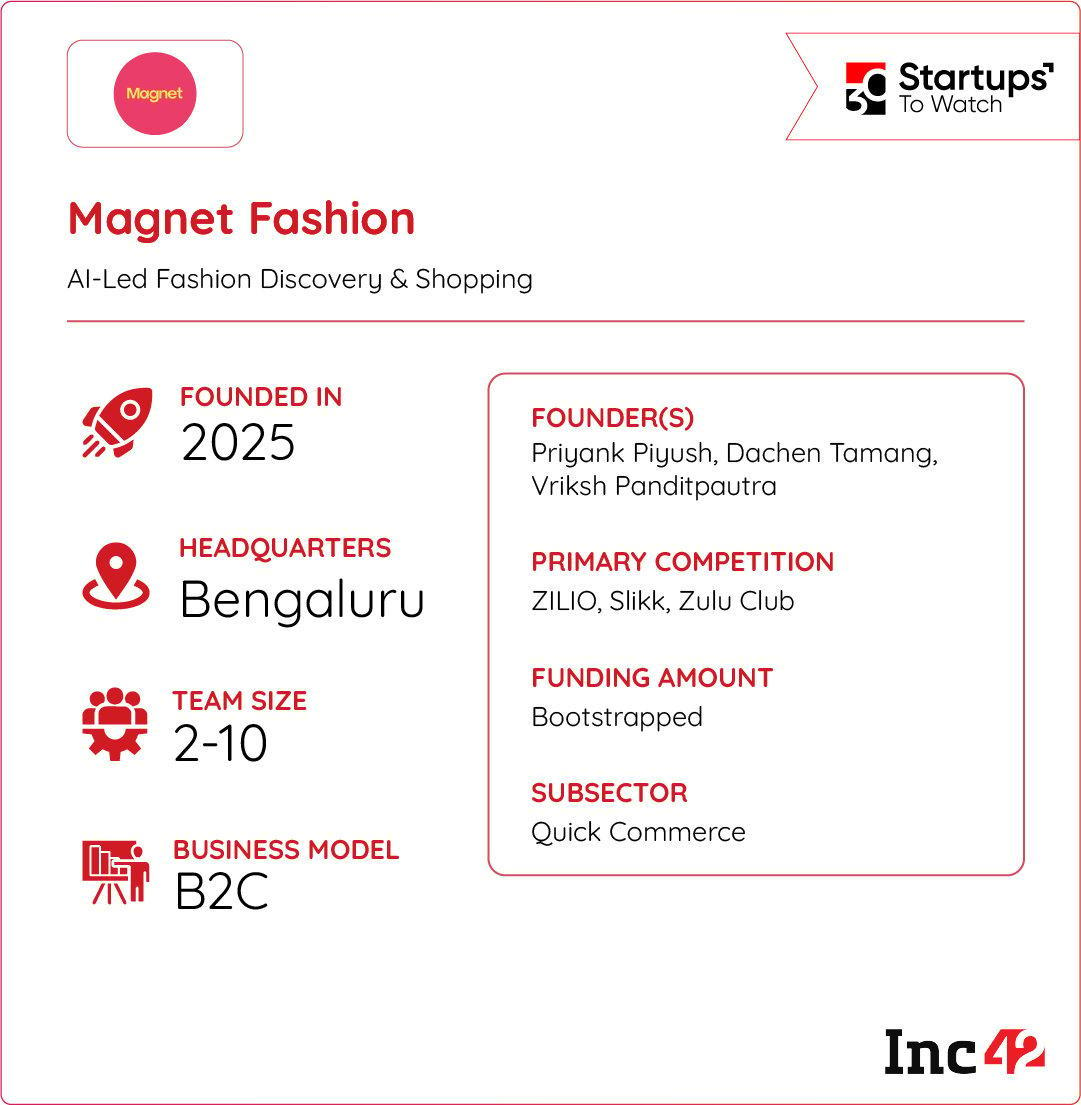

Inc42 Startup Spotlight How Magnet Is Building A New-Age Marketplace For WomenQuick commerce has disrupted multiple retail categories in India, and fashion is emerging as the next big frontier. While consumers increasingly want instant access to the latest styles, most online fashion platforms still operate on traditional delivery timelines. This leaves a glaring gap for women who want the convenience of quick commerce without compromising on variety, discovery, or fitting.

Magnet Fashion is looking to fix this problem by building a new-age marketplace for women.

Bundling AI With Q-Commerce: The startup leverages AI to help shoppers discover new styles, giving them access to the latest trendy fashion. Additionally, it also offers a virtual try-on feature to gauge fit before purchase. Magnet curates collections from emerging D2C brands like Abnorml, White Chaos, and Burger Bae, with its four-hour quick commerce model serving as another key draw.

Launched in June, the startup is eyeing a pie of India’s growing apparel market, which will cross the $150 Bn mark by 2030. But, can it take on the likes of rivals like ZILO, KNOT and Slikk?

The post Q3 Funding Check, Will Zoho’s Arattai Stick & More appeared first on Inc42 Media.

You may also like

'Tariffs to help farmers': Trump announces meet with China's Xi; US soybeans in focus

Jane Goodall dead: World's 'top expert on chimpanzees' passes away at 91

EastEnders' Max Branning ordered out of Walford in scenes following shock Zoe Slater kiss

Newcastle player ratings vs Union SG: 10/10 awarded and Nick Woltemade proves his worth

3 policemen killed, dozens injured as PoK witnesses strike for second consecutive day