A year ago, Paytm was facing an existential crisis due to RBI’s crackdown. Result? The fintech giant bled revenues, and saw its merchants flee and losses climb, while its stock price was on a downward spiral. Beating all odds, Paytm charted a stunning turnaround and posted a profit of INR 123 Cr for the first time in Q1 FY26.

So, what has fuelled the dramatic reversal of fates?

Running Lean: Paytm spent the last year selling its cash-guzzling ticketing business, Paytm Insider, to Zomato and divesting its stake in PayPay to SoftBank. This helped the fintech major save capital and provided the financial flexibility to expand its core merchant payments vertical and invest in AI-led innovations.

Savings from AI-led automation and “disciplined cost structure” further helped the company rake in INR 1,110 Cr in revenues, up 23% YoY, from the payments business during the quarter.

The Lending Push: Simultaneously, Paytm aggressively scaled up its financial services business. A robust growth in merchant loan disbursements (under non-DLG model) and strong repeat borrower rates grew the segment’s revenue by a hefty 100% YoY to INR 561 Cr.

Here’s a quick takeaway of Paytm’s Q1 numbers:

-

- Revenue from operations grew 28% YoY to INR 1,918 Cr

- Paytm reported an EBITDA profit of INR 72 Cr against an EBITDA loss of INR 792 Cr a year ago

- The payment services vertical clocked a GMV of INR 5.39 Lakh Cr, up 7% YoY

- Merchant subscriptions stood at a record 1.30 Cr at the end of June, up 21 Lakh YoY

- Average monthly transacting users reached 7.4 Cr.

- Paytm’s total expenses declined 18% YoY to INR 2,016.1 Cr in Q1 FY26

While all eyes will now be on how markets react today to the fintech giant’s upbeat quarterly results, here is how refocussing on its core payments vertical helped Paytm turn profitable.

From The Editor’s DeskIndiQube’s INR 314 Cr Anchor Round: A day before its IPO, the managed workspace solutions provider issued 1.3 Cr equity shares to anchor investors at INR 237 apiece. IndiQube has set a price band of INR 225 to INR 237 for its public offer, which will close on July 25.

Akshayakalpa’s INR 500 Cr Run: Having stared at potential shutdowns six times in its nine-year lifetime, the D2C dairy brand today has built an organic dairy brand that is on track to exceed INR 500 Cr in sales. So, how did the startup manage to carve a niche in the market?

ideaForge’s Weak Q1: The listed drone tech startup’s consolidated operating revenue crashed 85% to INR 12.8 Cr in Q1 FY26 from INR 86.2 Cr in the year-ago quarter. Meanwhile, the company posted a net loss of INR 23.6 Cr as against a net profit of INR 1.2 Cr in Q1 FY25.

The $44 Mn Heist At CoinDCX: Days after hackers decamped with $44 Mn in assets from the crypto exchange’s coffers, the hunt is on to recover the funds and ascertain the identity of the malicious actors. But, how were the servers of CoinDCX breached?

MakeMyTrip’s Profitable Q1: The Nasdaq-listed OTA reported a 23% jump in its profit to $25.8 Mn in Q1 FY26 compared to $21 Mn in the year-ago quarter. However, revenues rose a meagre 5.6% YoY to $268.9 Mn during the quarter under review.

New CFO At Raise: Trading platform Dhan’s parent has appointed financial services veteran Amit Gupta as its group chief financial officer. Founded in 2021, Raise Financial Services operates in the Indian stock broking space and primarily targets users in Tier I and II cities.

Eternal Touches 52-Week High: Shares of the foodtech major surged as much as 14.8% to INR 311.60 during the intraday trade on Tuesday. The rally comes on the back of bullishness by brokerages and healthy revenue posted by the company in Q1 FY26.

Cyber Frauds See A Spike: Indians lost INR 22,845.73 Cr to cyber frauds in 2024, up 206% from INR 7,465.18 Cr in 2023. The government said that more than 9.42 Lakh SIM cards and 2,63,348 IMEIs have been blocked as part of its crackdown on cyber frauds.

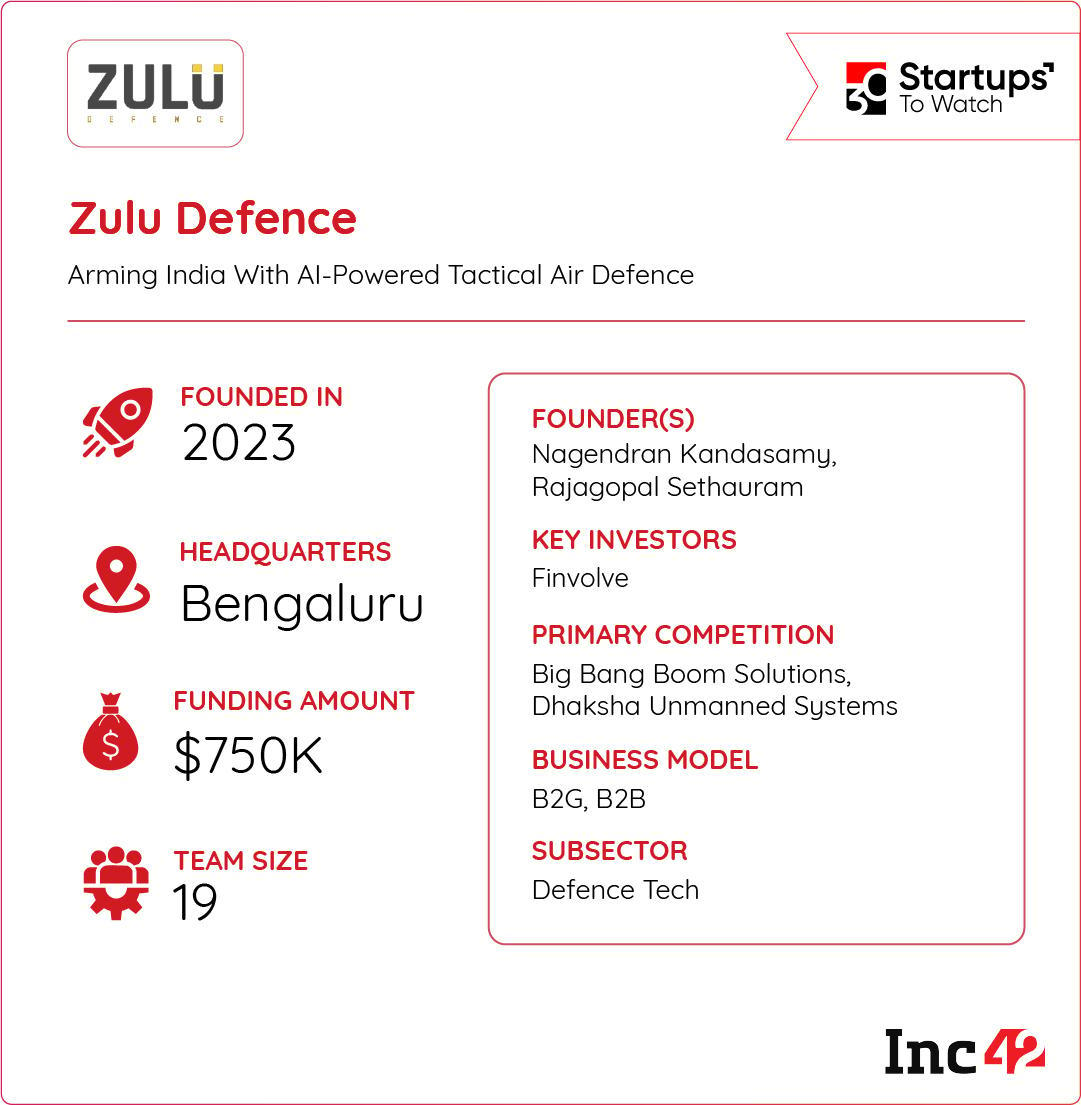

Inc42 Startup Spotlight Can Zulu’s Air Defence Shield Protect Indian Skies?The recent India-Pakistan conflict highlighted the need for highly advanced air defence systems to protect the country’s borders and skies. As a result, there is a growing clamour for not just owning such tech, but building such capabilities indigenously.

To fill this white space, Nagendra Kandasamy and Rajagaupal Sethauram founded Zulu Defence in 2023.

Zulu’s Stack: The startup is building AI-powered air defence systems, which can protect the Indian skies from enemy threats. The Bengaluru-based startups’ flagship product VLOUME35 is a weaponised unmanned aircraft system (UAS) that can carry missiles and specialises in long-range engagement, high mobility and automated operations.

RECON90 is another UAS from the startup’s kitty, which has AI-powered capabilities to track and identify objects.

Opportunity Ahead: What gives the startup an edge is the integration of AI and computer vision into its UAS platforms, which reduces the need for human intervention. With this, Zulu is tapping into a broader Indian defence market that is projected to become a $56.95 Bn opportunity by 2034.

As the Union government pushes the pedal on boosting air defence capabilities with homegrown solutions, can Zulu’s advanced air defence solutions protect India’s skies?

The post Paytm Is Profitable, IndiQube Suits Up For IPO & More appeared first on Inc42 Media.

You may also like

Crazy conspiracy theory on Andy Byron's wife viral: 'No one realized this probably wasn't an accident'

Afghanistan: Six workers killed, several injured in coal mine explosion

Bihar Police Bharti 2025: Apply Now for 4,361 Driver Constable Posts – Great Opportunity in Bihar Police

Bhopal: 27-Year-Old Female Doctor Found Hanging At Residence; Reason Behind Death Yet Unclear

'Help me find my missing son's body so I can bury him at home'