India’s mattress industry, which is usually not in the spotlight, finds itself in a strange new place in 2025.

Almost a decade after Sheela Foam, the parent company of popular mattress brand Kurlon and Sleepwell went public, another popular mattress manufacturer Duroflex is heading for a public listing in the next 18 months. And there’s Wakefit from the startup ecosystem, which is also gunning for the bourses.

Now, everyone wants to know more about how to judge mattress companies. But the thing is, Wakefit is more than just that today. The startup has diversified in the past four years to become a furniture and mattress brand, so much so that the balance is now shifting.

The Bengaluru-based startup, a much younger company compared to legacy giants Sheela and Duroflex, filed its IPO papers to raise INR 468 Cr ($546 Mn) via fresh issue of shares. Promoters Ankit Garg and Chaitanya Ramalingegowda and investors such as Peak XV Partners, Redwood Trust, Paramark and Verlinvest will sell their shares in the IPO.

And there’s good reason to believe that Wakefit has found a formula that’s been missing for many D2C brands that emerged around 2015 and 2016.

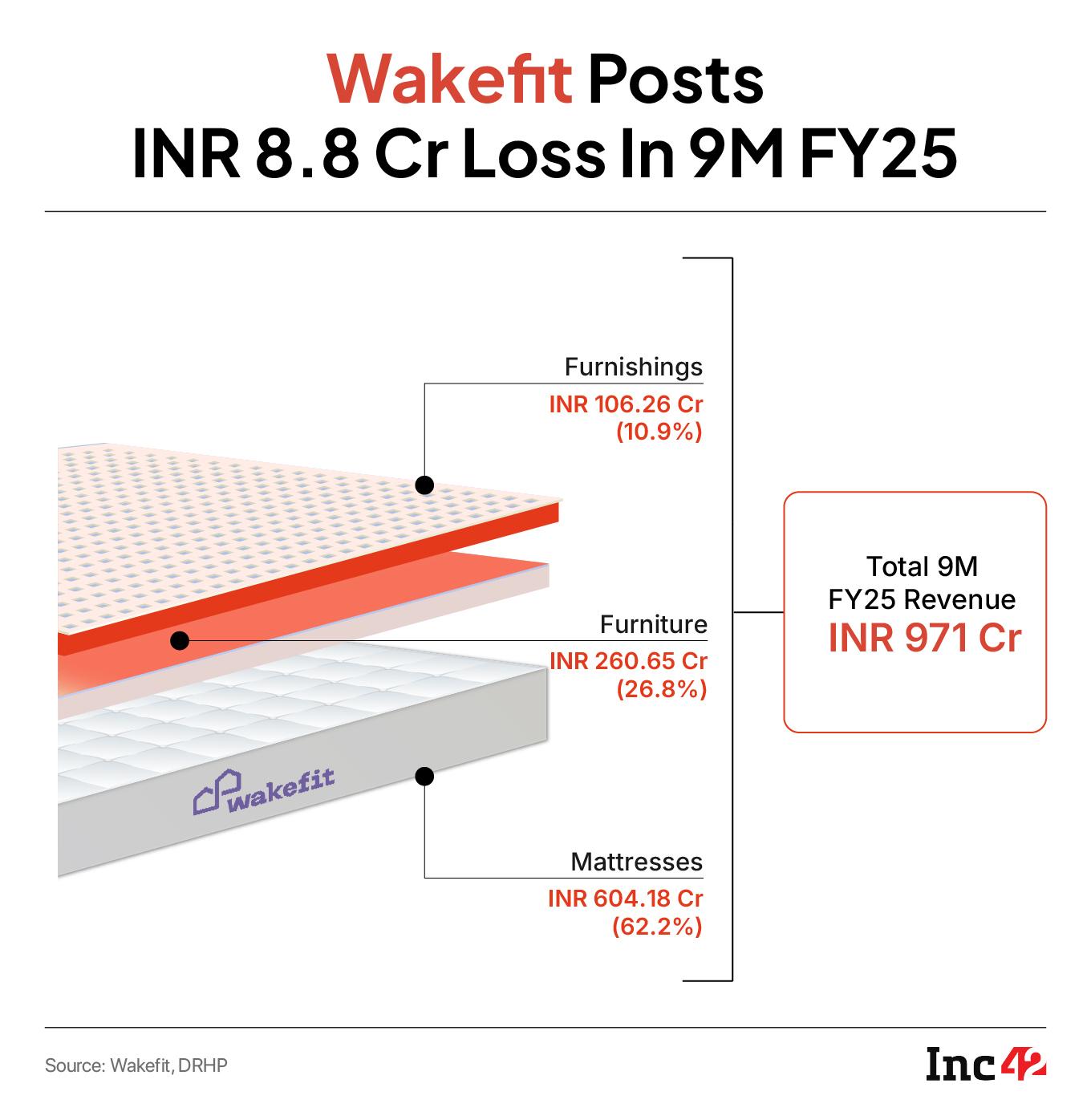

Laying The FoundationThe push into furniture in 2019 has likely taken Wakefit beyond the INR 1,000 Cr mark in revenue in FY25. It reported revenue of INR 971 Cr for the first nine months, which is about the same as its whole year revenue for FY24. This indicates a 20-25% growth in terms of revenue compared to FY24.

Plus, Wakefit’s EBITDA improved to INR 76.4 Cr (7.87% EBITDA margin) in 9MFY25 (As of December 2024) and operational profit touched INR 6.4 Cr in 9M FY25 after losses in the previous two fiscals. This indicates the business is seeing benefits of operating leverage, and the INR 8.8 Cr loss on a consolidated basis is certainly not a worrying factor at this scale.

For context, the company reported a net loss of INR 15 Cr in FY24 against a similar revenue base. So how much of a role did the shift to furniture play in this turnaround?

While the mattress segment is a cornerstone for the startup, Wakefit’s furniture business has grown the fastest in the last three years. The startup’s growing offline presence is a key factor in this shift.

From a single company-owned store in FY22, Wakefit had 98 stores as of December 2024. This number is likely to have grown in the past six months. So essentially, the company has seen a 100x growth in this aspect.

From a single company-owned store in FY22, Wakefit had 98 stores as of December 2024. This number is likely to have grown in the past six months. So essentially, the company has seen a 100x growth in this aspect.

In offline retail, Wakefit needed to push to achieve store-level profitability and the furniture category proved critical to SKU build-up. The number of SKUs has grown by a third since FY24 from just over 2,300 to 3,070.

Wakefit managed to reduce its expenditure, by pruning its two biggest expenses – procurement cost, and employee cost. It is not clear how Wakefit brought down its procurement cost, however, the reduction in employee cost was mainly due to increase in automation in manufacturing.

On the other hand, advertisement expenditure increased, but ad spend as a percentage of revenue dropped significantly to 8.51% in 9MFY25, highlighting a degree of brand loyalty and high brand recall.

From Sleep To EverythingFounded in 2016, Wakefit did not waste much time in diversifying, even though for the longest time the startup was known as the mattress brand. It was as early as 2018 when Wakefit received its first furniture order.

In the early years, the startup only focused on bed frames, study tables, among others. This has grown to a number of categories in the past two years in particular.

The diversification has paid off as average order value (AOV) has increased considerably, showing that Wakefit’s cross-selling and upselling strategies have worked to some degree.

A consumer buying a bed for their house would typically buy the mattress from the same manufacturer.

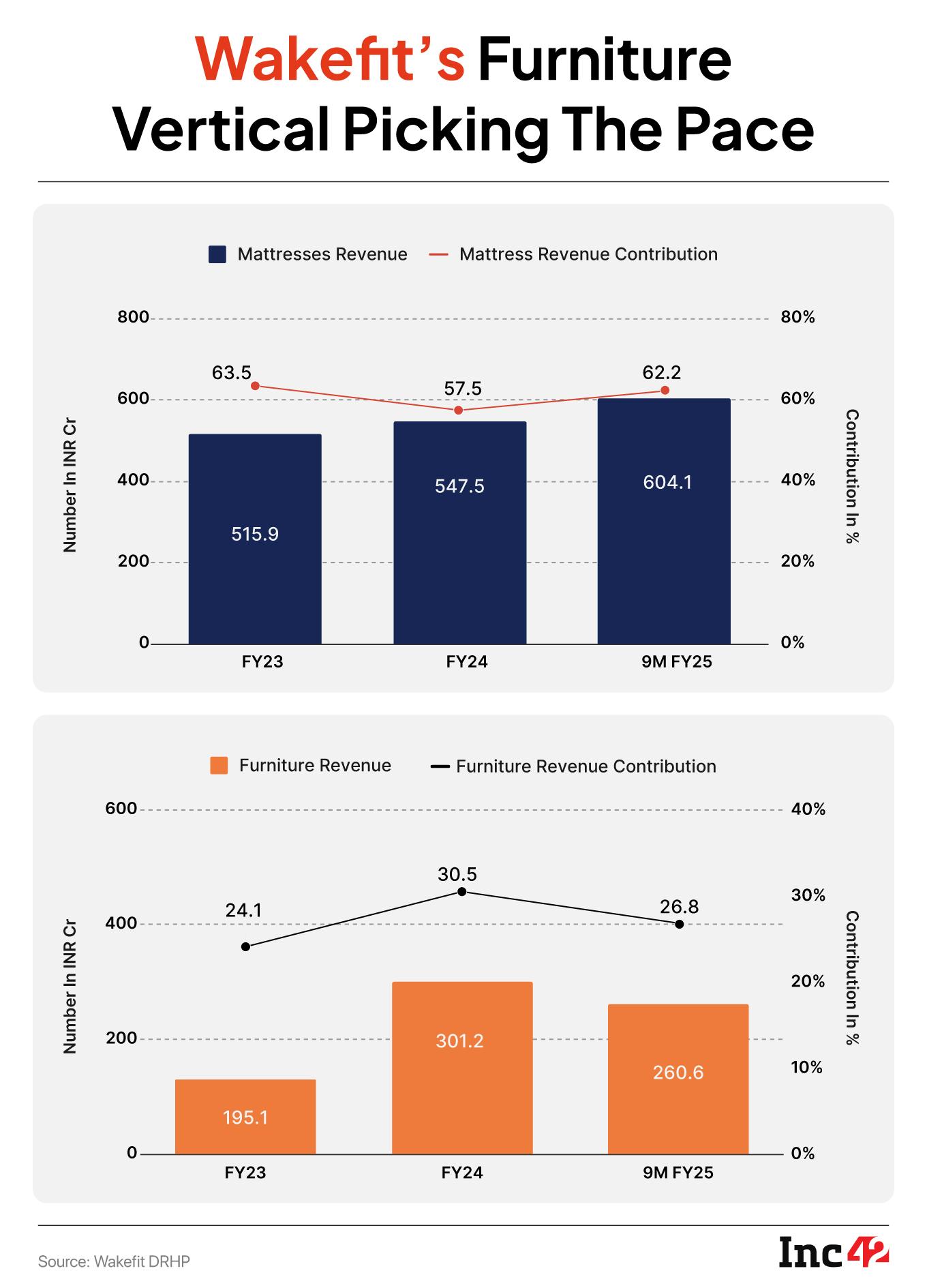

While currently, the mattress segment continues to be the strongest revenue generator for Wakefit with 57.5% in FY24, the furniture segment is the fastest growing segment with a 30.5% contribution in FY24 from 21% just two years ago.

In terms of AOV as well, furniture is a bigger contributor — INR 10,963 compared to INR 9,800 for the mattress segment as of 9M FY25. However, one thing we must note is that the furniture AOV has itself not grown significantly in the past three fiscal years.

Furniture was always a revenue play. Wakefit cofounder Garg said in 2022 that furniture segment would contribute 70% of the total revenue for the company by 2026. That has not yet come to fruition but Wakefit is on track to shift the balance.

In the first nine months of FY25, the mattress segment added 62.2% of the startup’s overall revenue with a sales of INR 567.5 Cr. This is almost 2X of what Wakefit’s fastest growing segment – furniture segment – reported during the same period.

On the other hand, Wakefit’s furniture vertical launched 2,534 SKUs, a significant jump from 1,065 SKUs in FY24, contributing the bulk to the product line-up.

It will not be easy to scale up the revenue to the claimed 70% mark. Despite the high AOV, furniture vertical has high warehousing, delivery, and return costs. Moreover, furniture as a category has lower repeat purchase rates due to the higher shelf life.

With the launch and expansion of the likes of IKEA and competitors like Wooden Street, Pepperfry, Urban Ladder, Godrej Interio and a host of other furniture brands, there is no dearth of competition for Wakefit.

According to a Redseer report, Indian’s home and furnishing market was valued at $35 Bn in 2024 and is projected to grow at 12% CAGR, reaching $66 Bn in market size by 2030.

Just under a third of this market is the organised segment, and more than half of the organised market share is owned by Sheela Foam, Duroflex, and other legacy brands. Wakefit, The Sleep Company, Sleepy Cat, Pepperfry, and Duroflex-owned Sleepy Head and dozens of other brands compete for a thin slice.

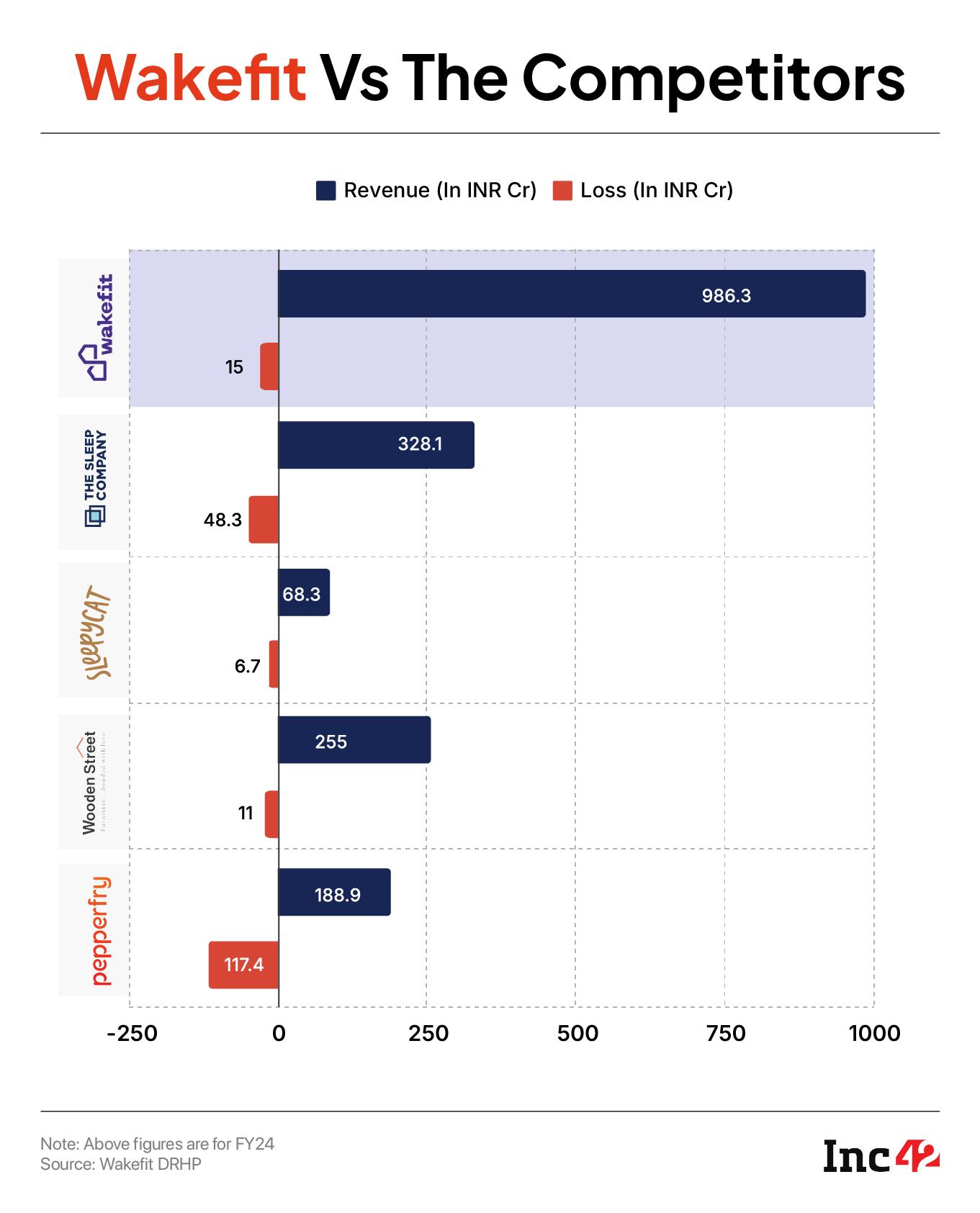

Interestingly, Wakefit generated more revenue than The Sleep Company, Sleepy Cat, Wooden Street and Pepperfry combined in FY24. Sheela Foam, the parent company of Sleepwell, posted an operating revenue of INR 2,982.3 Cr in FY24, which was the highest in the segment.

Interestingly, Wakefit generated more revenue than The Sleep Company, Sleepy Cat, Wooden Street and Pepperfry combined in FY24. Sheela Foam, the parent company of Sleepwell, posted an operating revenue of INR 2,982.3 Cr in FY24, which was the highest in the segment.

Wakefit’s revenue of INR 986 Cr in FY24 was marginally behind Duroflex’s INR 1,095 Cr in the same year.

Ad spending is likely to increase but so will R&D cost to innovate and iterate on the product portfolio. Fresh product lines are vital for furniture businesses as tastes evolve constantly. The retail presence will help bring in higher returns on ad spend, but Wakefit will have to craft a strategy for channels that suit smaller towns and cities such as multi-brand outlets (MBOs) and large format stores.

Is Wakefit Flipping The Mattress?All this focus on furniture begs the question: are mattresses no longer Wakefit’s focus?

It is hard to see how the company can do that without compromising on its brand recall. The wake is quite literally part of the name.

While furniture has become the SKU fountain, mattress offers Wakefit flexibility in terms of distribution, and that’s thanks largely to the brand equity. So mattresses will not be shunted to the side any time soon.

Brand collaborations with rental startups such as Rentomojo, launching on quick commerce platforms, and more importantly personalised offerings have become the focus here. From memory foam and dual foam, today Wakefit sells orthopaedic, latex, and pocket spring mattresses and other form factors like pillows.

From a revenue contribution of 65% in FY22, the mattress vertical dropped to 57.54% in FY24. Not a big drop, but significant in terms of the actual revenue. This despite its average order value increasing year on year.

It must be stressed that mattress as a category has not de-grown, but other segments have grown faster. This is due to significantly increased investments in growing the non-mattresses category, as SKUs of furniture and furnishing category increased.

Besides, mattress sales tend to have a longer replacement cycle of 7-10 years, whereas furniture buying is more frequent and driven by discretionary depending when companies launch new product lines.

As Wakefit goes from a mattress brand to a holistic home solutions startup, there has been a significant internal shift in KPIs and marketing budgets towards newer verticals.

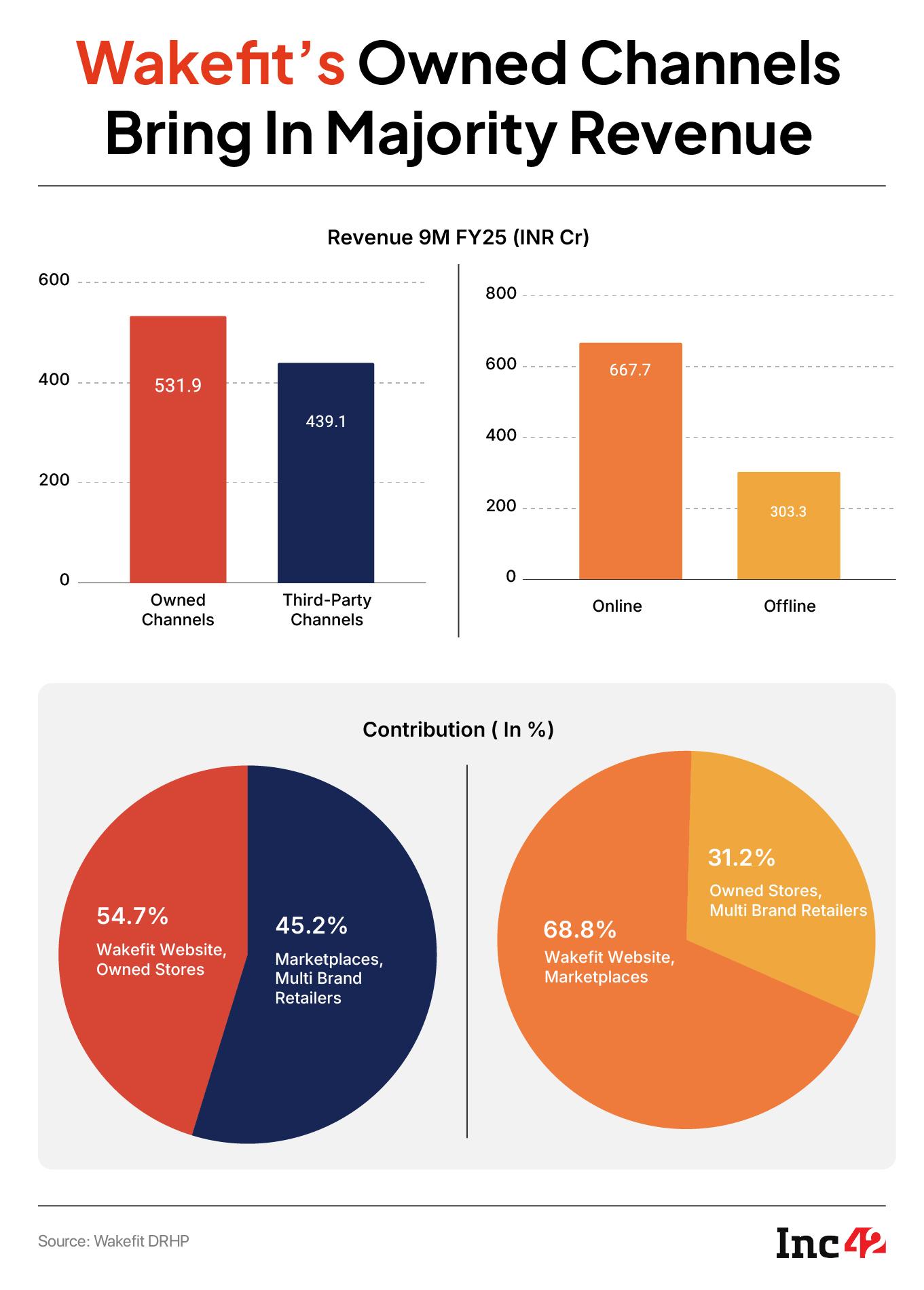

Channel Mix Is Wakefit’s StrengthIt’s no secret that the majority of D2C startups in the country depend on marketplaces to drive sales, but that is not the case for Wakefit today.

To this day, the startup generates the majority of its revenue through its own channels i.e. its website and company-owned retail stores. These brought in INR 531 Cr in sales in 9M FY25 or 55% of total sales.

From around 100 stores, the company aims to have close to 220 stores by the end of FY28, and intends to invest INR 31 Cr from the potential IPO proceeds towards this end.  Selling through its own channels gives the brand a strategic edge, as it not only allows the startup to retain higher margins by avoiding third-party commissions, but it also offers greater visibility and control over inventory, and builds loyalty among customers. Cross-selling is a major incentive in the furniture business and owning the channels allows Wakefit to leverage this to its full potential.

Selling through its own channels gives the brand a strategic edge, as it not only allows the startup to retain higher margins by avoiding third-party commissions, but it also offers greater visibility and control over inventory, and builds loyalty among customers. Cross-selling is a major incentive in the furniture business and owning the channels allows Wakefit to leverage this to its full potential.

For now, Wakefit appears to be in a strong competitive position and has built a brand engine that seems to be ready for prime time when the company hits the public markets. But a different kind of test awaits post the IPO, especially as the competition steps up its game. Wakefit cannot afford to rest on its past.

Edited By Nikhil Subramaniam

The post From Mattress To Everything: Analysing Wakefit’s INR 1,000 Cr Furniture Biz appeared first on Inc42 Media.

You may also like

The 'best' phone of the year confirmed but has Android or iPhone come out on top?

Emma Raducanu complaints made by Wimbledon star after crossing paths with Brit

Breaking barriers: Meet UAE's first female ammunition and explosives technician

Trump raises entry fees for foreign tourists at US national parks to fund upgrades

'Ghana ghoom rahe hain': Sanjay Raut takes 'vikas purush' jibe at PM Modi, flags poor roads in Varanasi